Accounting Equation Cost of Goods Sold

Beginning inventory Purchases - Ending inventory Cost of goods sold Example of Calculating the Cost of Goods Sold A company has 10000 of inventory on hand at. When the textbook is sold the bookstore removes the cost of 85 from its inventory and reports the 85 as the cost of goods sold on the income statement that reports the sale of the.

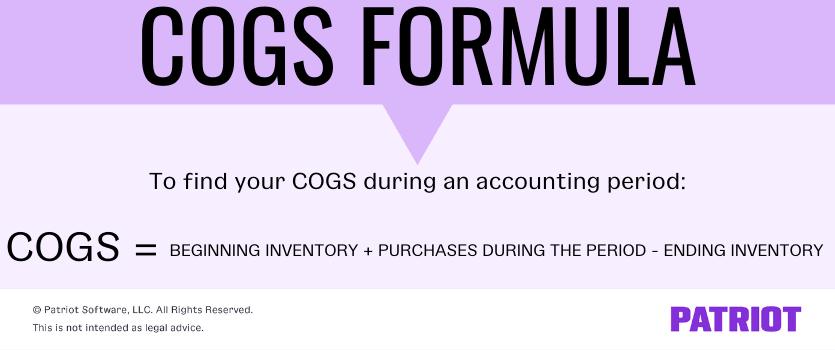

Cost Of Goods Sold Definition Cogs Formula More Patriot Software

To determine the cost of goods sold multiply 2 by 500.

. Heres how calculating the cost of goods sold would work in this simple example. The cost of goods sold COGS also referred to as the cost of sales or cost of services is how much it costs to produce your products or services. Lets take a look at how to calculate cost of goods sold.

COGS beginning inventory purchases during. Formula The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the. Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods Your average cost per unit would be the total inventory 2425.

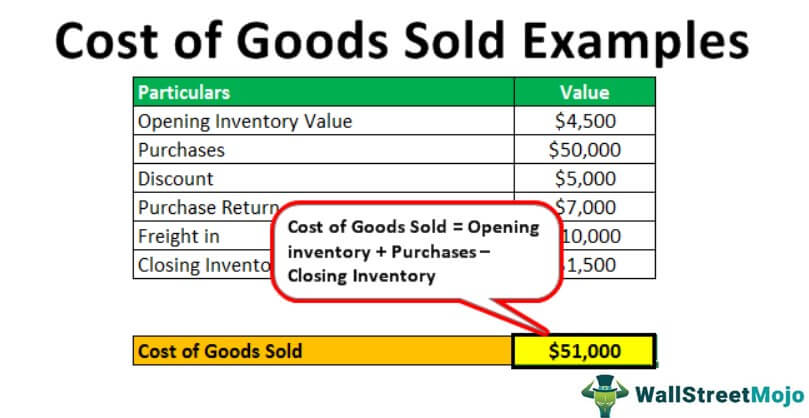

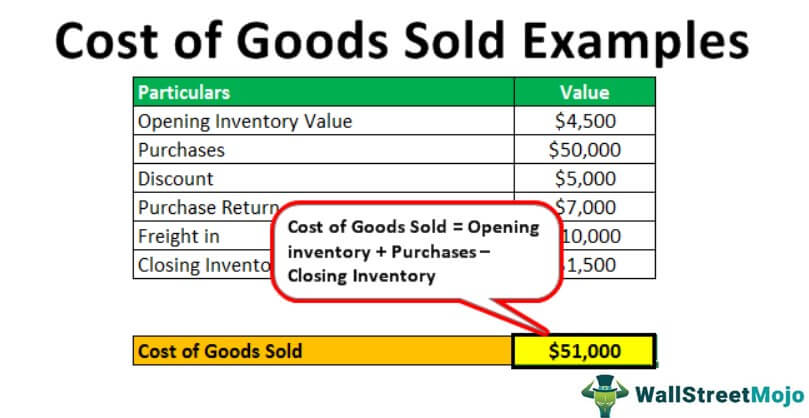

Cost of Goods Sold Beginning Inventory Purchases during the year Ending Inventory Cost of Goods Sold 20000 5000 15000 Cost of Goods Sold 10000 Cost of Goods Sold. COGS is equal to the sum of the beginning inventory plus additional inventory minus. Its cost of goods sold for Year 2 was 2377100 and sales were 3565650.

Using the cost of goods sold equation you can plug those numbers in as such and discover your cost of goods sold is 33000. Cost of goods sold is calculated using the following formula. Rated The 1 Accounting Solution.

Rated The 1 Accounting Solution. You can calculate this by using the following formula. Calculating Cost of Goods Sold COGS The formula for calculating COGS.

To make this work in practice however. Cost of goods sold formula. Beginning Inventory Cost of Goods - Ending Inventory Cost of Goods Sold At the beginning of the year the.

The 1260 difference between revenue and cost of goods sold. LoginAsk is here to help you access Accounting Total Cost Formula quickly and. Calculating Cost of Goods Sold COGS The formula for calculating COGS is relatively simple.

Beginning Inventory Cost of Goods Ending Inventory Cost of Goods. QuickBooks Financial Software For Businesses. The cost of goods sold formula is simple to use.

Recorded in their journal the entry might look like this. Gross profit is obtained by subtracting COGS from revenue while gross margin is gross profit divided by revenue. If a business has a beginning inventory worth 10000 purchases raw materials during the year for 15000 and the remaining inventory left for 5000 calculation of the cost of goods sold will be.

Ad Get Complete Accounting Products From QuickBooks. Cost of goods sold. At a basic level the cost of goods sold formula is.

Accounting Total Cost Formula will sometimes glitch and take you a long time to try different solutions. In these cases it is. QuickBooks Financial Software For Businesses.

Your pro forma income statement shows sales of 953000 cost of goods sold as 516000 depreciation expense of 99000 and taxes of 135200 due to a tax rate of 40. Removing 1820 leaves an inventory balance of 260 780 1300 1820 representing the cost of the one remaining unit. Starting inventory purchases ending inventory cost of goods sold.

The spas total cost of goods sold for a batch is 1000. Ad Get Complete Accounting Products From QuickBooks. The amount of merchandise on hand was 664000 and total assets amounted to 3671900.

The higher a companys COGS the lower its gross profit.

Cost Of Goods Sold Formula Calculator Excel Template

Cost Of Goods Sold Examples Step By Step Cogs Guide

Cost Of Goods Sold Cogs Formula And Calculator

Cost Of Goods Sold Cogs Formula And Calculator

0 Response to "Accounting Equation Cost of Goods Sold"

Post a Comment